The Pradhan Mantri Awas Yojana (PMAY) is a flagship initiative by the Government of India launched in 2015, aiming to provide affordable housing for all eligible urban and rural poor. Divided into PMAY-Urban and PMAY-Gramin, the scheme offers financial assistance and interest subsidies on home loans, making homeownership more accessible for Economically Weaker Sections (EWS), Low-Income Groups (LIG), and Middle-Income Groups (MIG).

Beyond just building houses, PMAY emphasizes sustainable construction, women’s empowerment through joint ownership, and improved access to basic amenities like water, electricity, and sanitation, ultimately enhancing the quality of life for millions of citizens.

What is Pradhan Mantri Awas Yojana (PMAY)?

The Pradhan Mantri Awas Yojana (PMAY) is a credit-linked subsidy scheme through which the central government, in collaboration with state governments, provides affordable housing for India’s low- and moderate-income residents.

The central government has set a target to construct 3 crore houses under PMAY by 2029, with 2 crore allocated for PMAY-Gramin and 1 crore for PMAY-Urban 2.0.

Objective of PMAY

The key objective of this scheme is to provide financial assistance to economically weaker rural and urban families, enabling them to build, purchase, or upgrade their homes. According to official data, more than 92.61 lakh houses have been completed under the scheme so far.

PM Awas Yojana in Different States

Click on your state to learn the eligibility, benefits, and other essential details.

Overview of PMAY

PMAY is divided into two main categories:

- PMAY-Urban (PMAY-U): Focuses on urban areas, helping citizens in cities who do not own pucca houses.

- PMAY-Gramin (PMAY-G): Aimed at rural households, helping families living in dilapidated houses or without any form of shelter.

| Aspect | Details |

| Scheme Name | Pradhan Mantri Awas Yojana (PMAY) |

| Launch Year | 2015 |

| Objective | To provide affordable housing to all citizens, especially to the economically weaker sections, low-income groups, and rural areas. |

| Implemented By | Ministry of Housing and Urban Affairs (for urban areas) & Ministry of Rural Development (for rural areas) |

| Target Beneficiaries | Low-income families, homeless individuals, scheduled castes (SC), scheduled tribes (ST), other backward classes (OBC), minority communities, women heads of families |

| Main Components | 1. Beneficiary-Led Construction (BLC) 2. Affordable Housing in Partnership (AHP) 3. Credit-Linked Subsidy Scheme (CLSS) |

| Financial Assistance (Urban) | – Economically Weaker Sections (EWS): Subsidy on loans up to ₹6 lakh, 6.5% interest rate |

| – Lower Income Groups (LIG): Subsidy on loans up to ₹6 lakh, 6.5% interest rate – Medium Income Group (MIG 1): Subsidy on loans up to ₹9 lakh, 4% interest rate – Medium Income Group (MIG 2): Subsidy on loans up to ₹12 lakh, 3% interest rate | |

| Financial Assistance (PMAY-Gramin) | ₹1.2 lakh (60% from the central government, 40% from the state government) for house construction. Additional benefits include ₹18,000 for 100 days of employment under MGNREGA and ₹12,000 for toilet construction under Sauchalay Sahayata Yojana. |

| Loan and Interest Subsidy | CLSS: Interest subsidy based on the applicant’s annual income group and loan amount |

| Maximum Loan Amount (PMAY-Urban) | Up to ₹6 lakh for EWS & LIG; ₹9 lakh for MIG 1; ₹12 lakh for MIG 2 |

Who is Eligible For PM Awas Yojana

The scheme’s eligibility varies based on income and housing status:

PMAY-Urban (PMAY-U)

- EWS: Annual income up to ₹3 lakh.

- LIG: Annual income between ₹3 lakh and ₹6 lakh.

- MIG-I: Annual income between ₹6 lakh and ₹9 lakh.

- MIG-II: Annual income between ₹9 lakh and ₹18 lakh (for credit-linked subsidies).

- Slum Dwellers: Residents of informal settlements.

PMAY-Gramin (PMAY-G)

The applicant must belong to at least one of the following categories:

- Homeless families.

- Families residing in houses with one or two rooms, constructed with rough walls and a rough roof.

- Should not own a pucca house anywhere in India.

- Families with no literate adult member above 25 years of age.

- Families without any adult male members aged between 16 and 59 years.

- Families with no capable or working members and containing a disabled member.

- Landless families earning income through casual labour.

- Belonging to Scheduled Castes (SC), Scheduled Tribes (ST), Other Backwards Classes (OBC), or Minority communities.

Some Additional Eligibility Conditions

- The applicant must be a resident of India.

- The applicant must not own a permanent house.

- The applicant should be at least 18 years old.

- The applicant’s name must be listed in the ration card or the BPL (Below Poverty Line) list.

- It is compulsory for the applicant to be registered in the voter list and possess a valid identity proof linked to the voter ID.

- The scheme encourages the female head of the family to be the owner or co-owner of the house.

Benefits and Subsidies Provided Under PMAY

For PMAY-G (Gramin/Rural Population)

Benefits under Pradhan Mantri Awas Yojana are provided through a collaborative effort between the Central Government and State Governments, with the majority of the financial responsibility borne by the Central Government. However, for Union Territories, the financial support is completely provided by the Central Government.

Beneficiaries can build a pucca house with a minimum size of 25 sqm, including proper cooking space. They will also receive one LPG connection through the Pradhan Mantri Ujjwala Yojana.

The eligible beneficiaries under Pradhan Mantri Awas Yojana get a financial assistance of ₹1,20,000, whereas for remote locations and hilly areas, the amount is ₹1,30,000. Here is the fund allocation structure under the PM Awas Yojana:

| Area Types | Cost Sharing | Ratio (Centre:State) | Price Assistance/Unit |

| Plain Area | Centre and State | 60:40 | ₹1,20,000 |

| Hilly Area/Remote Areas | Centre and State | 90:10 | ₹1,30,000 |

| Union Territories | Centre | 100:0 | _ |

In addition to financial support, you can also opt for 100 days of employment for house construction under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), which provides an additional benefit of ₹18,000. The government also offers financial assistance of ₹12,000 for toilet construction under the Sauchalay Sahayata Yojana.

If you choose to utilise all these options, the total benefit you could receive in your bank account may range from ₹1,50,000 to ₹1,60,000, depending on your location.

For PMAY-U (Urban Population):

- In-Situ Slum Redevelopment: Beneficiaries in slum areas receive up to Rs 1 lakh in subsidies.

- Beneficiary-led Individual House Construction/Enhancement:

- EWS households can receive up to Rs 1.5 lakh in subsidies.

- EWS beneficiaries can build a pucca house with a maximum carpet area of 30 sqm.

- LIG beneficiaries can construct houses with up to 60 sqm carpet area.

- MIG-I category beneficiaries can build houses up to 160 sqm.

- MIG-II category beneficiaries can build houses up to 200 sqm.

- Home Loans with Interest Subsidy: Beneficiaries can avail home loans with interest subsidies ranging from 3% to 6.5%, depending on the loan amount.

- Affordable Rental Housing: Migrant beneficiaries from EWS and LIG categories are eligible for rental housing under the “Affordable Rental Housing Complexes” scheme, offering affordable rental options.

Here is the breakdown of the benefits.

| Category | Annual Income | Loan Amount | Interest Subsidy |

| Economically Weaker Section (EWS) | Less than 3 lakh | Up to ₹6 lakh | 6.5% |

| Lower-Income Group (LIG) | ₹3 lakh to ₹6 lakh | Up to ₹6 lakh | 6.5% |

| Middle Income Group (MIG-1) | ₹6 lakh to ₹12 lakh | Up to ₹9 lakh | 4% |

| MIG-2 | ₹12 lakh to ₹18 lakh | Up to ₹12 lakh | 3% |

Tax Benefits Under Pradhan Mantri Awas Yojana

Apart from the financial support, you can also avail of tax deductions under the PM Awas Yojana.

Here are the tax benefits provided under this scheme:

| Income Tax Sections | Tax Benefits |

| Section 80C | Annual deduction of ₹1,50,000 from the Home Loan Principal. |

| Section 24(b) | Deduction of up to 2 lakh from the Home Loan interest payment. |

| Section 80EE | Annual tax relief of up to ₹50,000 for first-time home buyers. |

| Section 80EEA | Tax deduction of ₹1,50,000 from Home Loan interest payment. |

Carpet Area for PM Awas Yojana

As mentioned earlier, the Pradhan Mantri Awas Yojana offers varying subsidised loan amounts to families across different income groups, including EWS, LIG, and MIG. Along with that, the carpet area is also different for applicants of these categories.

According to government regulations, the net usable floor area of the apartment is known as the carpet area.

Here is the carpet area for different categories:

| Category | Carpet Area |

| EWS and LIG | 30-60 square meters |

| MIG-1 and MIG-2 | 160-200 square meters |

Different Verticals of PM Awas Yojana

To achieve the “Housing for All” initiative, PM Awas Yojana is organised into four schematic verticals to effectively deliver benefits to eligible beneficiaries. The verticals are discussed as follows.

1. In-Situ Slum Redevelopment (ISSR)

This vertical provides a grant of ₹1 lakh per house for all houses constructed for eligible slum dwellers through in-situ slum redevelopment using land as a resource, with the participation of private developers.

2. Credit Linked Subsidy Scheme (CLSS)

Under this vertical, an interest subsidy of 6.5%, 4%, and 3% is available on loan amounts up to ₹6 lakh, ₹9 lakh, and ₹12 lakh, respectively. These subsidies are for eligible beneficiaries belonging to the Economically Weaker Section (EWS)/Low Income Group (LIG), Middle Income Group-1 (MIG-I), and Middle Income Group-2 (MIG-II), seeking housing loans from banks, housing finance companies, and other financial institutions.

3. Affordable Housing in Partnership (AHP)

The scheme offers central funding of ₹1.5 lakh per EWS house in projects where at least 35% of the total houses are allocated for EWS beneficiaries, with a minimum project size of 250 houses. The central assistance is provided to the state government, which, in collaboration with private sector partners or federal agencies, undertakes the development of affordable housing for EWS beneficiaries.

4. Beneficiary-led Individual House Construction or Enhancement (BLC)

Under this vertical, eligible families in EWS categories receive central assistance of ₹1.5 lakh for constructing or enhancing their individual houses.

How to Apply for PMAY?

The application process for PM Awas Yojana is straightforward. You can choose to apply either online or offline based on your convenience.

For PMAY-U (Urban):

- Visit the official portal: pmay-urban.gov.in

- Click on the ‘Apply for PMAY-U 2.0’ option.

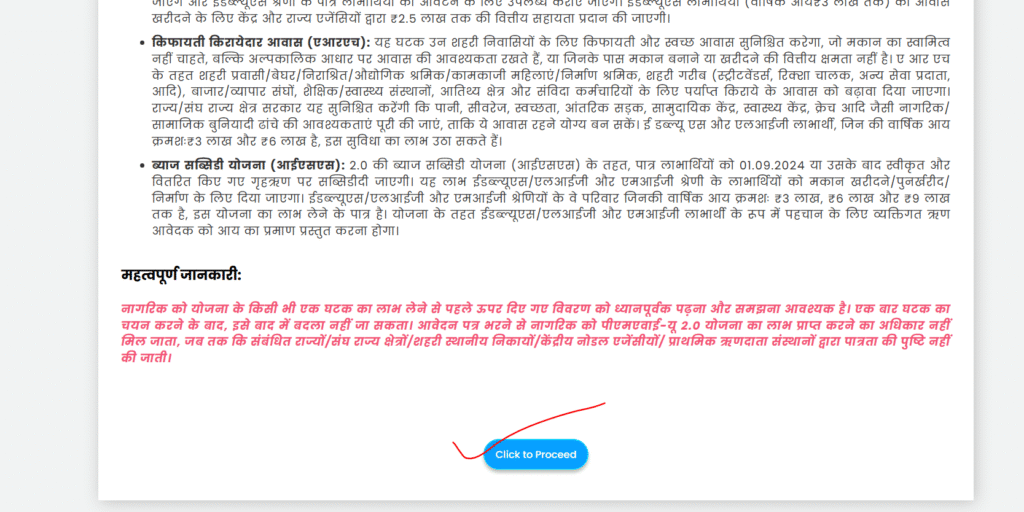

- On the next screen, scroll down and click on the ‘Proceed‘ button after the user instructions and document sections.

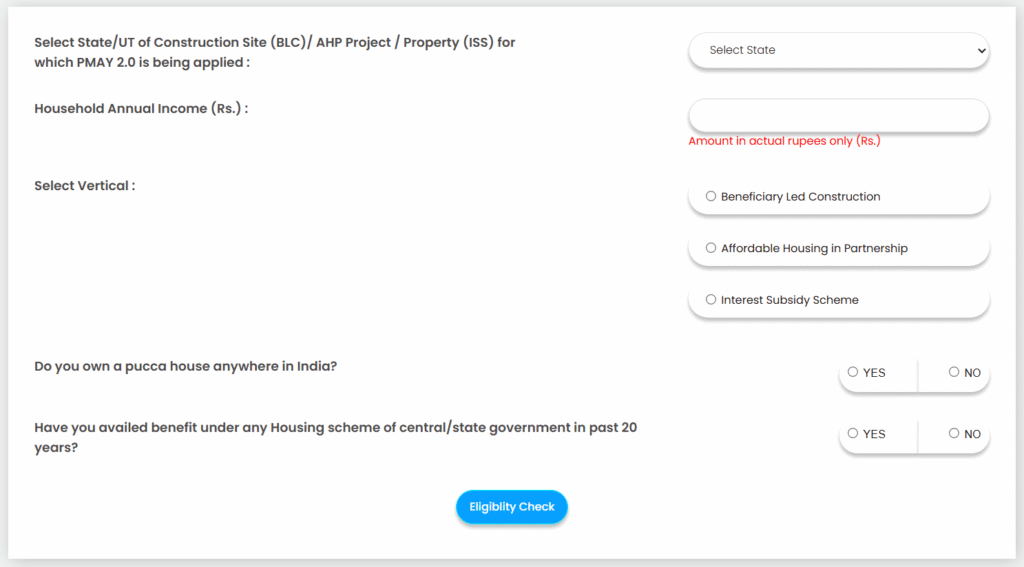

- On the following screen, enter your state, annual income, verticals, and other details to check eligibility.

- If eligible, a new screen will appear to enter your name and Aadhaar number.

- You will receive an OTP on your Aadhaar-linked mobile number.

- Enter the OTP to access the online form.

- Fill out the form and submit it.

For PMAY-G (Rural):

For Pradhan Mantri Awas Yojana-Gramin, there is no direct online application process for the applicant. However, the beneficiaries will be selected based on the caste census as notified by your panchayat office.

If you are left out of the survey and are eligible for this scheme, you can visit your panchayat office with all necessary documents to complete the application process.

You can also do self survey using AwaasPlus App.

Documents Required For PMAY

For PMAY-U:

- Aadhaar card (self and family members)

- Bank account details linked to Aadhaar

- Proof of income

- Land/property ownership documents (if applicable)

For PMAY-G:

- Aadhaar card

- MGNREGA job card

- Bank account details

- SBM (Swachh Bharat Mission) number

- Self-declaration affidavit of not owning a pucca house

How To Track PM Awas Yojana Application Status

Whether you’ve applied for PMAY-Urban (PMAY-U) or PMAY-Gramin (PMAY-G), you can check your application status online at your own convenience. Here’s the process on how to do that.

Application Tracking Process For PM Awas Yojana-Urban

Applicants under the PMAY-Urban scheme can track their application using various methods on the official portals.

Option 1: Track PMAY-U Status via PMAYUCLAP Portal

If you applied for a housing subsidy under PMAY-Urban, you can check your status through the PMAYUCLAP website using different identification methodsm, such as: By Aadhar number, PMAY Application ID, and Registered Mobile Number.

Process to Check Status Using PMAYUCLAP

- Visit the PMAYUCLAP tracking page.

- Select the desired option to track application by ‘Beneficiary code/Application no.’, ‘Name as per Aadhar’, or ‘Mobile no.’

- Enter the details.

- Your application details and status will appear on the screen.

Option 2: Check Status via Local Authority or Toll-Free Number

- You can contact your local municipal office to check your status in person.

- You can also call the PMAY-U toll-free helpline for real-time updates.

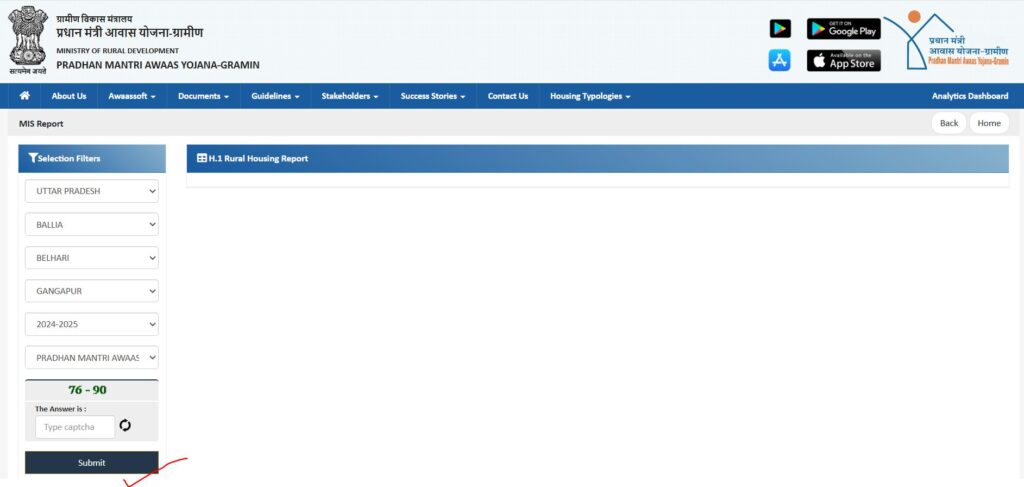

Process to Check PM Awas Yojana-Gramin (PMAY-G) Application Status

If you have applied under PMAY-Gramin (PMAY-G), which is the rural housing scheme, you can search beneficiary details through a different portal.

Option 1: Track Status Using Registration Number

- Visit the official PMAY-Gramin website: pmayg.gov.in

- Click on the “Awassoft” option from the top menu bar.

- Select the “Report” option from the dropdown menu.

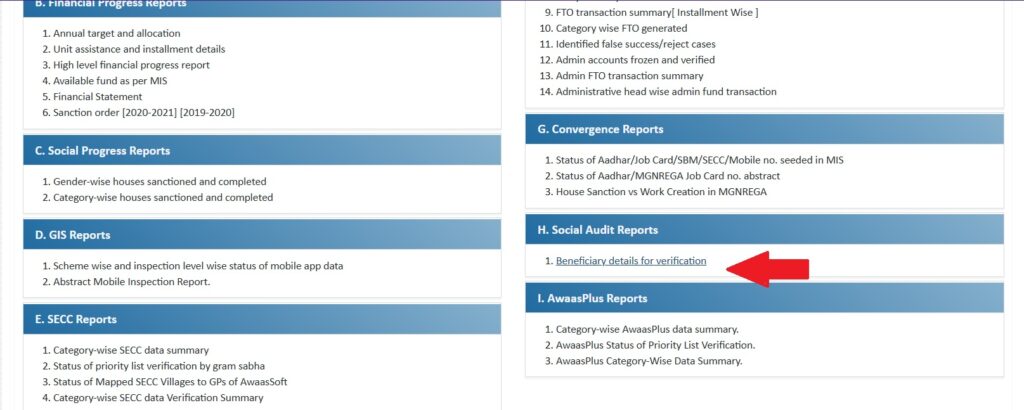

- After this, you will be taken to this page: rhreporting.nic.in/netiay/newreport.aspx

- On this page, scroll down to the bottom and select the “Beneficiary details for verification” option.

- In the following page, you need to select your state, district, block name, village name, and financial year from the dropdown options.

- Select Pradhan Mantri Awas Yojana Gramin in the last menu.

- Enter the captcha and click on the submit button.

- The list of beneficiaries will appear on your screen.

Option 2: Track Status Without Registration Number (Advanced Search)

If you don’t have your registration number:

- Select the ‘Advanced Search’ option on the same website.

- Enter:

- State, District, Block, Panchayat

- Your Full Name

- State, District, Block, Panchayat

- Click ‘Submit’ to see the list of beneficiaries and find your application details.

How Long Does the PMAY Application Process Take?

Once the application is submitted, it generally takes around 3 to 4 months for the application to be processed and accepted.

PMAY Subsidy Processing & Tracking Stages

PMAY applications go through several stages before the subsidy is processed and released:

- Application ID Generation.

- Due Diligence by PLI (Primary Lending Institution).

- Claim uploaded on Central Nodal Agency Portal.

- Subsidy claim approval.

- Subsidy released to PLI.

Applicants can track the status of their subsidy at each stage via the PMAY UCLAP portal.

What is The Last Date For The Application Process

The government has extended the deadline to apply for the Pradhan Mantri Awas Yojana (PMAY) till December 31, 2025, giving eligible urban and rural households additional time to register for affordable housing support.

Helpline Number

If you encounter any issues with the above processes or need additional information regarding the PMAY scheme, please feel free to contact the helpline number provided below.

| Service | Helpline Number | |

| PMAY-G | Toll Free Number: 1800-11-6446 | support-pmayg@gov.in |

| PMAY-U | Toll Free Number: 011-23063285, 011-23060484 | pmaymis-mhupa@gov.in |

| PFMS | Toll Free Number: 1800-11-8111 | helpdesk-pfms@gov.in |

Frequently Asked Questions

Who is considered a ‘beneficiary family’ under the PMAY scheme?

A beneficiary family is defined as a husband, wife, and their unmarried children. However, an adult earning member (irrespective of their marital status) can be treated as a separate household for the purpose of the scheme. It is a crucial eligibility condition that the family should not own a pucca house in their name or in the name of any family member in any part of India. The property for which the subsidy is sought must be their first home.

What are the key differences between PMAY-Urban and PMAY-Gramin?

PMAY-U and PMAY-G are distinct programs addressing housing needs in different geographical areas. PMAY-U, implemented by the Ministry of Housing and Urban Affairs, focuses on providing affordable housing in urban areas.

PMAY-G, under the Ministry of Rural Development, aims to provide pucca houses with basic amenities to homeless and those living in dilapidated houses in rural areas. While both schemes offer financial assistance, the implementation models, beneficiary identification methods, and the amount of assistance vary according to the specific needs of urban and rural populations.

For example, PMAY-G identifies beneficiaries using the Socio-Economic and Caste Census (SECC) data, whereas PMAY-U has different components like Credit Linked Subsidy Scheme (CLSS) and In-situ Slum Redevelopment (ISSR).

How is the subsidy under the Credit Linked Subsidy Scheme (CLSS) calculated and disbursed?

Under CLSS, beneficiaries can avail an interest subsidy on their home loans. The amount of subsidy and the eligible loan amount vary based on the beneficiary’s income category (EWS, LIG, MIG I, and MIG II). The subsidy is calculated as an upfront amount, which is then deducted from the principal loan amount. As a result, the beneficiary pays the EMI on the reduced principal loan amount. The subsidy is disbursed by the Central Nodal Agencies (CNAs) to the Primary Lending Institutions (PLIs), who in turn credit it to the borrower’s loan account.

Is it mandatory for a female family member to own or co-own the house to avail the benefits of PMAY?

Yes, under PMAY-U for the Economically Weaker Section (EWS) and Low-Income Group (LIG) categories, it is a mandatory provision for the female head of the family to be the owner or co-owner of the house.

What is the process for applying for the PMAY scheme?

The application process for PMAY-U can be done both online and offline.

For PMAY-G, eligible people can visit their Gram Panchayat office or block office and submit the required documents.